PPFAS vs Quant, which mutual fund to invest in?

It's like giving money to Warren Buffet vs giving it to Jim Simons, you will make money in both cases but your risk appetite forces you to choose one over the other.

When a new investor decides to start their mutual fund investing journey, they search for the “Best Mutual Funds in the last 5 years” on the internet. In almost all categories, two names pop up; Quant Mutual Fund and Parag Parekh Mutual Fund (PPFAS henceforth). Most people go with Quant because it has been at the top for many years, but when your investment in it falls, people panic. In the case of PPFAS, people panic relatively less because their downside protection is top-notch (that doesn't mean Quant's isn't). But, if you are a new investor and unable to figure out what to do, you are in the right place.

Both mutual funds have a massive fan base and manage more than ₹60,000 crores of investor's money, but their investment philosophy and styles couldn't be more different. PPFAS team is more like Warren Buffet - They do extensive analysis and find undervalued, high-quality companies with massive upside and hold those companies for the long-term, i.e. their portfolio churn is very low.

On the other hand, the Quant team is "same same but different" - Same because like PPFAS, they also do extensive analysis and find high-quality, undervalued companies with massive upside. The difference is that their analysis is based on high-frequency data-based models that capture market sentiments. Hence, they sell the stock when market sentiments change, i.e. their portfolio churn (also called turnover ratio) is high. For example, Quant's turnover ratio is around 390 for their Flexi Cap Fund, the category average is 72, and PPFAS Flexi Cap has a turnover ratio of just 30.

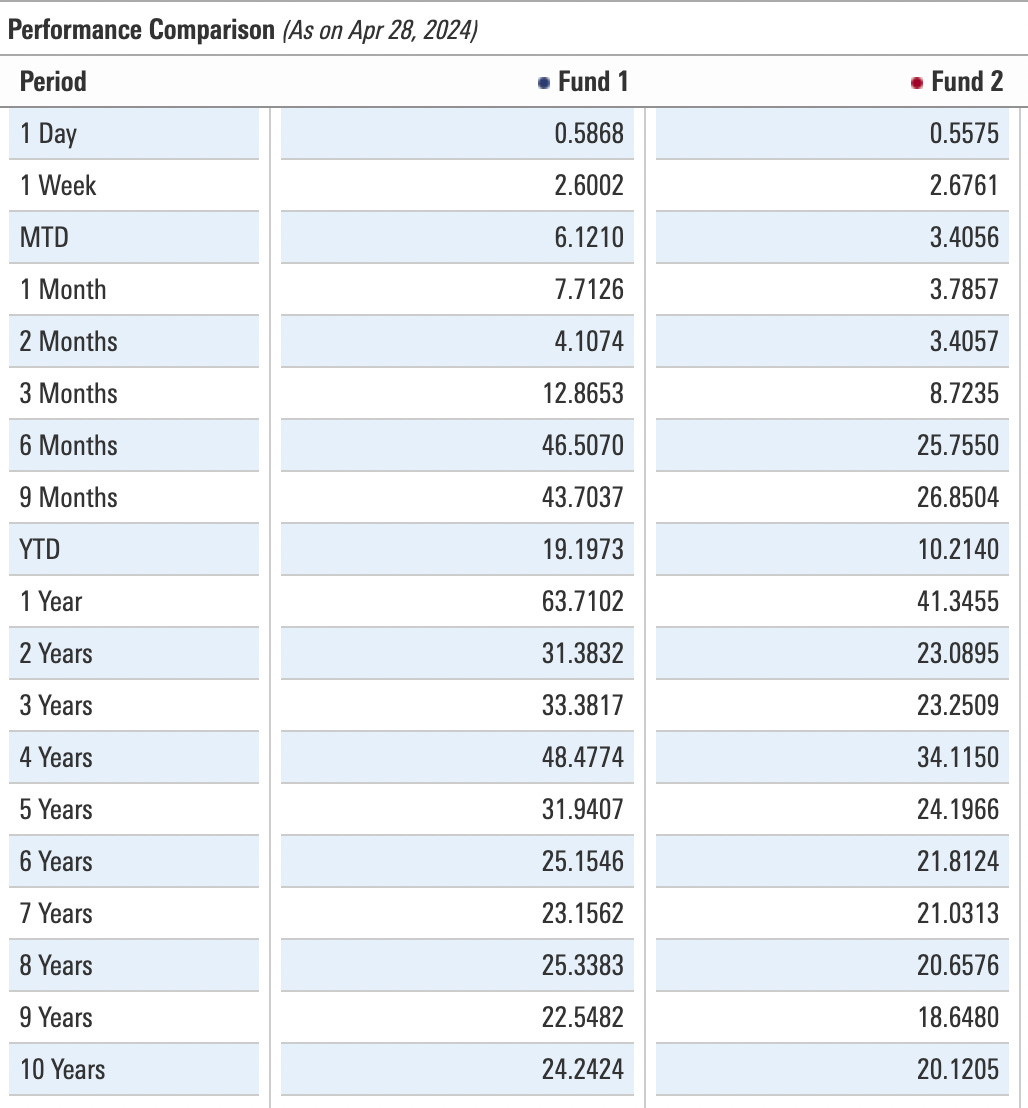

Let’s compare PPFAS’s Flexi Cap Fund with Quant’s Flexi Cap Fund.

Here, the Fund 1 is “Quant Flexi Cap Fund Direct Growth” and Fund 2 is “Parag Parikh Flexi Cal Fund Direct Growth”. You can see that in the last 2, 3, 5, and 10 years, Quant has given much better returns than PPFAS. But if you have followed my guide (read here), you know past returns are not the only thing we see before investing in a mutual fund. Let’s see other numbers.

Basically, the answer depends on who are you as an investor? Are you the one who doesn’t want to take high risk but still wants market beating returns? Clearly, you should go for PPFAS as your fund house. But if you can take risk and can bear more volatility (higher the standard deviation, higher is the volatility), then you should go for Quant as a mutual fund house. A similar analysis can be done for “Tax Saver ELSS” category and you will reach the same conclusion (read green and purple boxes above).

One issue that has been consistently raised by PPFAS enthusiasts is their AUM is consistently increasing. Usually it is not a concern but when AUM is this high (~₹53,000 crores), the ability of the fund to generate consistently high returns decreases. If you really want to invest in the PPFAS Flexi Cap Fund but have an issue with their AUM, the management of PPFAS suggests to invest in their ELSS Fund which has a very similar investment style (read from the image below).

Read this to know more about ELSS Funds and why they are underrated.

Wrapping up

Both fund houses have different appeals and if you are clear about the risks you can take, it won’t be tough to pick a side. There’s another option - Use a combination of both funds. This can help you diversify your investments across different investing styles.

Three things to keep in mind after you have chosen your mutual fund:

You should always invest in a “Direct” fund and not a “Regular” fund, read this article to find out why.

To create massive long-term wealth, avoid huge churn, i.e. stay invested for as long as you can, it will surely help you. DO NOT TRY TO TIME THE MARKET!!

Stay focused, and do not get swayed by stock tips because it is harder to create huge long-term wealth using stocks, read this to know why.

DISCLAIMER: Mutual Funds are subject to market risk. Do your research before investing your hard-earned money. Please read all the scheme documents carefully before investing.

If you found this useful, share it with your loved ones so that you all make well-informed decisions.

I have in my portfolio - Quant Flexi Cap, Quant small cap, and Quant large cap - all 3 funds. And they have given a great return ❤️ in the last 2 years so far. But I didn't know all these nitty-gritties and details of these funds that you shared, as any layman investor would (as you mentioned) only focus on the return in the last few years before investing. We don't get into stuff like expense ratio etc. But thank-you for this insightful read! This made me one-step smarter in my investing journey 😅